Ethereum is a decentralized blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). It operates using Ether (ETH), the cryptocurrency of the network, which powers transactions and computational processes. Ethereum, launched in 2015 by Vitalik Buterin and others, has since become one of the most prominent and versatile blockchain platforms.

The History of Ethereum’s Creation

Ethereum was conceived in late 2013 by Vitalik Buterin, a Russian-Canadian programmer. Buterin saw Bitcoin’s potential but believed that blockchain technology could do more than simply transfer money. He envisioned a blockchain capable of supporting decentralized applications (dApps) and executing smart contracts automatically. Ethereum’s development began in early 2014, and the platform officially launched in July 2015 with its first version, known as “Frontier.”

Ethereum’s blockchain was created to be more flexible than Bitcoin’s, allowing for complex programming beyond just simple transactions. Ether, its native cryptocurrency, was introduced as an incentive for participants to secure and run the network.

The Technology Behind Ethereum

Blockchain and Smart Contracts

Ethereum operates on a blockchain, much like Bitcoin, but with added functionality. While Bitcoin’s blockchain is primarily designed to handle financial transactions, Ethereum’s blockchain allows for smart contracts. These are self-executing contracts with the terms of the agreement directly written into code. Smart contracts automatically enforce and execute contract terms when predefined conditions are met, eliminating the need for intermediaries.

- Smart Contracts: These are scripts that execute predefined actions based on inputs, allowing for trust less transactions without third-party oversight.

Decentralized Network

Ethereum’s decentralized network works similarly to Bitcoin, with thousands of nodes around the world verifying and recording transactions. However, Ethereum extends decentralization to support dApps and smart contracts, which run on a virtual machine (EVM) across the network. This structure makes Ethereum highly resistant to censorship and tampering

Ethereum Transactions: Speed, Costs, and Scalability

| Aspect | Value (approximate) |

|---|---|

| Transactions per sec | 15–30 |

| Average fee | $2–$10 (depends on network demand) |

| Confirmation time | 10–20 seconds |

Transaction Speed and Costs

Ethereum processes about 15 to 30 transactions per second (TPS), significantly more than Bitcoin but still limited in comparison to centralized networks like Visa. Transaction fees, known as “gas,” fluctuate depending on network activity. Gas fees are used to pay for the computational work required to execute transactions or smart contracts on the Ethereum network.

Scalability Challenges

Ethereum’s primary scalability challenge is its limited throughput. As the number of users and dApps on the network grows, transaction costs can increase, and speeds can slow down.

Scaling Solutions

- Ethereum 2.0 (ETH 2.0): A major upgrade that shifts Ethereum from Proof of Work (PoW) to Proof of Stake (PoS), allowing for better scalability, energy efficiency, and security.

- Layer 2 Solutions: Technologies like Optimistic Rollups and zk-Rollups, built on top of Ethereum’s blockchain, aim to reduce congestion by processing transactions off-chain.

Ethereum’s Environmental Impact

Energy Consumption of Mining

Ethereum currently uses Proof of Work (PoW) for consensus, which is energy-intensive. Ethereum miners must solve complex mathematical problems to validate transactions, consuming a large amount of electricity. However, the Ethereum community has been working to transition to a more energy-efficient system, Ethereum 2.0, which will use Proof of Stake (PoS) to replace mining.

Sustainable Mining Approaches

Unlike Bitcoin, Ethereum has taken significant steps towards reducing its environmental impact by transitioning to Proof of Stake, which requires far less energy. PoS uses validators to confirm transactions rather than miners, drastically reducing the network’s carbon footprint.

Current and Future Developments in the Ethereum Ecosystem

Recent Technologies and Partnerships

- Ethereum 2.0: A major upgrade that aims to make Ethereum faster, more scalable, and less energy-consuming by shifting to Proof of Stake.

- DeFi Growth: Decentralized Finance (DeFi) applications have exploded on Ethereum, enabling lending, borrowing, and trading without traditional intermediaries.

- NFT Marketplaces: Ethereum is the primary blockchain for NFTs (Non-Fungible Tokens), which have revolutionized digital art and collectibles.

Regulatory Developments

Governments worldwide are beginning to regulate cryptocurrencies, including Ethereum, as they address concerns such as consumer protection, taxation, and anti-money laundering efforts. Many countries have imposed or are considering taxes on crypto transactions.

Long-Term Perspectives

- Transition to PoS: Ethereum 2.0 is expected to significantly increase scalability and reduce energy consumption.

- DeFi and NFTs: Ethereum’s dominance in decentralized finance and digital art will likely grow, cementing its place as a leading blockchain.

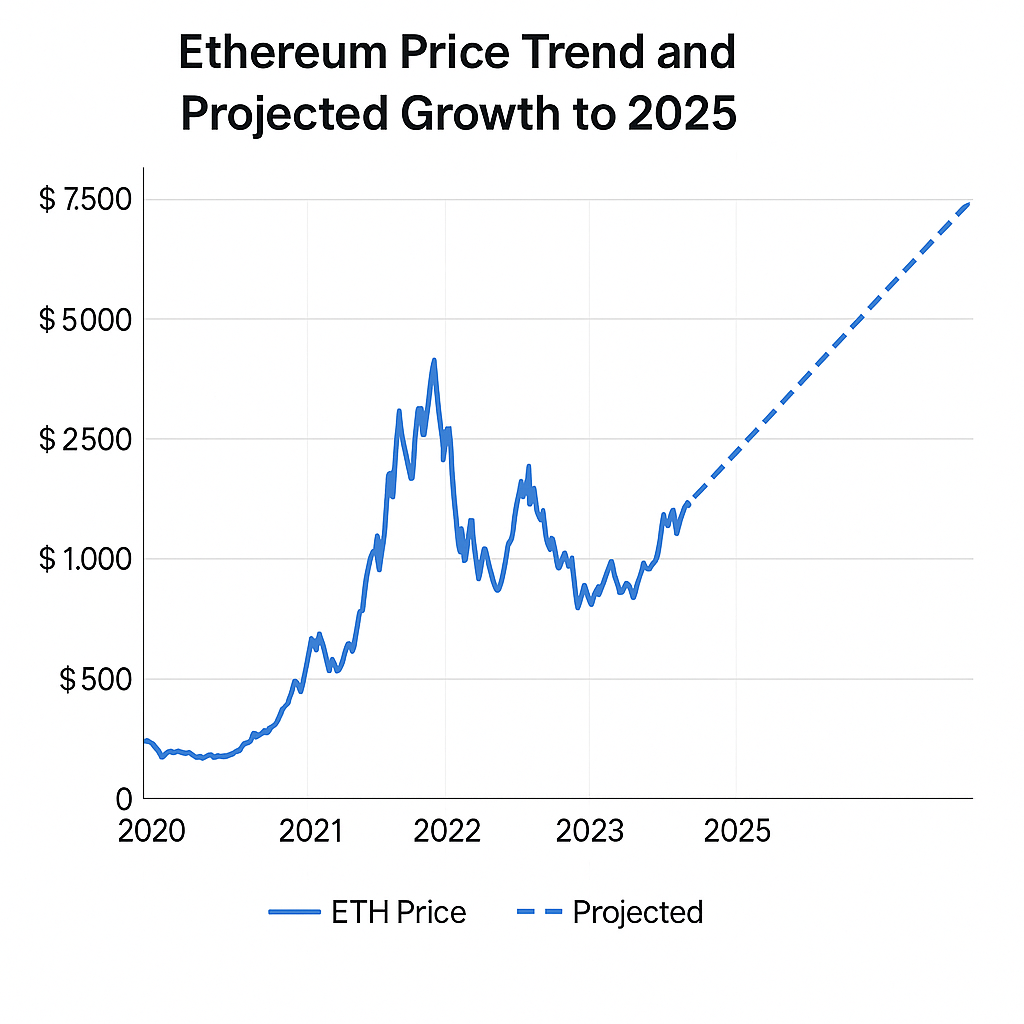

Ethereum Price Forecast Until the End of 2025

Ethereum’s price has been volatile, but with growing adoption of DeFi and NFTs, analysts are optimistic about its future. By 2025, Ethereum’s price could range from $5,000 to $15,000, depending on factors like network upgrades, regulatory clarity, and broader market conditions.

Factors Influencing the Price

- Ethereum 2.0 Transition: The success of ETH 2.0 is crucial for Ethereum’s scalability and long-term value.

- DeFi and NFTs: The continued growth of decentralized finance and the NFT market could push Ethereum’s value higher.

- Regulation: Government regulations could either stifle or promote growth, depending on their approach.

Advantages of Ethereum Over Other Cryptocurrencies

- Smart Contracts: Ethereum allows the creation and execution of self-executing contracts without intermediaries.

- Flexibility: Ethereum is more versatile than Bitcoin, supporting decentralized applications (dApps) and tokens (ERC-20).

- Large Ecosystem: Ethereum has a broad developer community and widespread adoption, especially in areas like DeFi and NFTs.

Why Ethereum Is Referred to as “The World Computer”

Ethereum is often called “The World Computer” because it allows developers to build decentralized applications that can operate on a global, trustless platform, making it much more than just a cryptocurrency.

Disadvantages of Ethereum Compared to Other Cryptocurrencies

- High Transaction Fees: Gas fees can become expensive during periods of high network congestion.

- Scalability Issues: Ethereum can currently handle around 15–30 transactions per second, which is insufficient for large-scale adoption.

- Energy Consumption: Despite transitioning to Proof of Stake, Ethereum still relies on Proof of Work for part of its network, causing concerns about energy consumption.

Is Ethereum Anonymous?

Ethereum is not fully anonymous, as all transactions are visible on the public blockchain. However, user identities are not directly linked to wallet addresses unless they voluntarily share them. Privacy-enhancing technologies, like zk-SNARKs (used in zk-Rollups), are being developed to improve privacy on Ethereum.

Is Ethereum Secure?

Ethereum’s security is based on the following:

- Blockchain Technology: Ethereum uses a decentralized ledger where no central authority can manipulate or alter data.

- Smart Contract Audits: Developers audit smart contracts to prevent vulnerabilities before deployment.

Risks Include:

- Smart contract vulnerabilities: Poorly written contracts can be exploited, leading to loss of funds.

- Hacks: DeFi platforms built on Ethereum have been targets for hacks and exploits.

Is Ethereum Decentralized?

Yes, Ethereum is decentralized. It operates on a distributed network of nodes, with no central control. Ethereum’s decentralized nature allows it to be resistant to censorship and manipulation, as no single entity controls the network.

- Access to decentralized financial services.

- Protection against inflation.

- Freedom from censorship and traditional financial controls.

Ethereum’s decentralized applications enable people in countries with underdeveloped banking systems to access the global economy.

How Countries and Governments Deal with Ethereum

| Country | Status/Approach |

|---|---|

| El Salvador | Legal tender for Bitcoin, Ethereum use in DeFi |

| United States | Regulation in development, Ethereum as a commodity |

| China | Banned cryptocurrency exchanges but allowed blockchain development |

| European Union | Exploring regulations for cryptocurrencies |

Governments’ reactions to Ethereum vary, from adoption in some countries to restrictions in others.

- Decentralized Finance (DeFi): Lending, borrowing, and trading without intermediaries.

- Smart Contracts: Automating contract execution.

- NFTs: Digital ownership of art, music, and more.

- Supply Chain Management: Tracking goods and services in a transparent, decentralized manner.

Can Ethereum Replace Gold?

While Ethereum and Bitcoin are often compared to gold as stores of value, Ethereum’s potential goes beyond what gold offers:

- Advantages: Decentralized applications and smart contracts provide more versatility.

- Limitations: Ethereum’s volatility makes it less stable than gold in the short term.

Ethereum is unlikely to replace gold but could complement it in the broader economy.

Worldwide Regulation of Ethereum

Ethereum’s legal status varies across countries, with most treating it as property or a commodity. As governments begin to introduce clearer regulations, Ethereum’s legal status will continue to evolve.

Ethereum’s decentralized nature, combined with its Proof of Work and Proof of Stake mechanisms, helps protect the network from centralized attacks. However, vulnerabilities exist in smart contracts, and decentralized applications (dApps) can be targets for hackers.