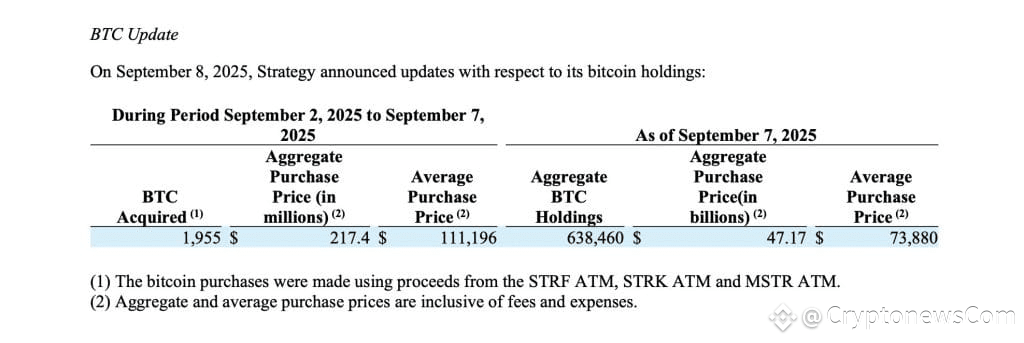

Strategy, the rebranded MicroStrategy, continued its aggressive Bitcoin acquisition strategy in September 2025, purchasing 1,955 BTC for $217.4 million, according to a filing with the U.S. Securities and Exchange Commission. The transaction, executed between September 2 and 7 at an average price of $111,196 per Bitcoin, underscores the company’s unwavering commitment to amassing the cryptocurrency as its primary treasury reserve asset. Led by Executive Chairman Michael Saylor, Strategy now holds 638,460 BTC, acquired for $47.17 billion at an average price of $73,880 per coin, reflecting significant unrealized gains with Bitcoin trading around $112,000

Strategy Funds Bitcoin Buy with $217 Million in Share Sales

The latest purchase was financed through at-the-market (ATM) offerings, including sales of Class A common stock (MSTR) and preferred stock series (STRF, STRK, STRD). Between September 2 and 7, Strategy sold over 750,000 shares across these programs, raising more than $217 million in net proceeds. This capital was immediately deployed to acquire the 1,955 BTC, demonstrating the company’s efficient use of equity markets to fuel its Bitcoin strategy. As of September 7, billions remain available under Strategy’s ATM programs, providing ample liquidity for future purchases. The firm’s year-to-date Bitcoin yield, a key performance indicator measuring the growth in Bitcoin per share, reached 25.8%, signaling robust returns for shareholders despite recent stock price volatility.

Saylor’s Wealth Climbs as Bitcoin Strategy Drives Market Influence

Michael Saylor’s personal fortune has surged alongside Strategy’s Bitcoin accumulation, landing him on the Bloomberg Billionaire Index with a net worth of $7.37 billion as of September 2025. His wealth, up 15.8% year-to-date, reflects his 9.9% ownership of Strategy’s shares and the company’s soaring market capitalization, which exceeds $121 billion. Strategy’s Bitcoin holdings, now over 3% of the cryptocurrency’s 21 million total supply, position it as the largest corporate holder globally, dwarfing competitors like Metaplanet and Semler Scientific. The firm’s consistent buying, even at elevated prices above $111,000, signals confidence in Bitcoin’s long-term appreciation, driven by institutional adoption and its fixed supply. Posts on X noted mixed investor sentiment, with some praising Saylor’s conviction while others expressed concern over stock dilution from frequent share sales.

Disclaimer

The information on this website is for educational purposes only, and investing carries risks. Always do your research before investing, and be prepared for potential losses.

18+ and Gambling: Online gambling rules vary by country; please follow them. This website provides entertainment content, and using it means you accept out terms. We may include partnership links, but they don't affect our ratings or recommendations.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and are not intended for UK consumers.