In the world of cryptocurrencies, you often hear the term “fork”. But what is a fork exactly? If you’re new here, think of it as a split in a blockchain’s road. When the software rules change, the blockchain may split into two, creating different paths. Some forks merge back, while others go on their way, creating new digital currencies. Here’s the lowdown on forks, their types, and some famous moments in crypto history.

What’s a Fork in cryptocurrency?

A fork happens when a blockchain’s protocol—the set of rules that computers follow to validate transactions—undergoes a change. Sometimes, the community and developers decide to update these rules to improve security, add features, or fix bugs. Other times, disagreements cause the blockchain to split, giving birth to a new crypto asset.

Simply put: a fork is like software updates on steroids. You either get an upgrade or a split. And since blockchains operate on consensus, everyone must agree on the changes. But not everyone does, especially when money’s involved.

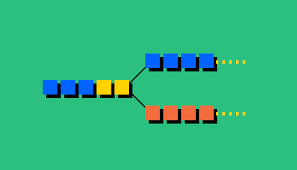

Two main types: Hard Forks and Soft Forks

Not all forks are created equal. The two popular kinds are hard forks and soft forks. Each behaves differently and affects the blockchain in unique ways.

Hard Forks

A hard fork is a pretty serious change that’s not backward compatible. That means nodes running the old software won’t agree with the new rules. This splits the blockchain into two separate versions, both continuing independently. If you think about it, it’s like a fork in the road where you have to pick a side, or you get left behind.

“A hard fork is a radical change to the protocol that makes previously invalid blocks/transactions valid, or vice-versa,” says Ethereum. “Nodes running previous versions will consider the new blocks invalid.”

Hard forks often create new cryptocurrencies. Take Bitcoin Cash for instance. It split from Bitcoin in 2017 because some miners wanted bigger blocks to process transactions faster. Result? Two coins: Bitcoin (BTC) and Bitcoin Cash (BCH). That fork was messy, controversial, and a reminder that blockchain governance isn’t always smooth sailing.

Soft Forks

Soft forks, on the other hand, are upgrades that remain backward compatible. Old nodes will still accept new blocks, so everyone stays on the same chain. These forks tighten the rules without breaking the network.

One of the well-known soft forks is Ethereum’s London upgrade, which introduced several improvements, including the highly anticipated EIP-1559. This update changed how transaction fees work and added deflationary pressure on ETH by burning some of the fees.

The London upgrade was a critical soft fork that improved fee predictability and aimed to reduce ETH supply growth.

Why do forks happen?

Forks occur for all sorts of reasons: software upgrades, fixing security flaws, or disagreements within the community. When too many users want to change the rules and the old version refuses to update, a hard fork can create a whole new blockchain.

Sometimes, it’s less dramatic, like a soft fork improving efficiency without upsetting the apple cart.

The blockchain industry faces a complicated dynamic. Protocol changes can mean everything from better security to ideological clashes about what a cryptocurrency should be. Forks expose the fragile balance between consensus and innovation.

Notable fork events in Crypto History

- Bitcoin Cash (BCH) Fork – 2017: A classic example of a contentious hard fork, separating Bitcoin into two coins with different visions for scalability.

- Ethereum London Upgrade – 2021: A coordinated soft fork that updated Ethereum’s transaction fee system, impacting the entire network without splitting it.

- Bitcoin SV (BSV) Fork – 2018: Another Bitcoin split focused on restoring the original Bitcoin protocol vision, further fragmenting user support.

Blockchain forks are at the core of how the crypto ecosystem adapts and evolves. Whether it’s a seamless upgrade or a divisive split, forks reveal the tension between progress and division in decentralized networks.

Disclaimer

The information on this website is for educational purposes only, and investing carries risks. Always do your research before investing, and be prepared for potential losses.

18+ and Gambling: Online gambling rules vary by country; please follow them. This website provides entertainment content, and using it means you accept out terms. We may include partnership links, but they don't affect our ratings or recommendations.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and are not intended for UK consumers.