Bitcoin is the world’s first decentralized digital currency—money that exists only as computer‑verified records yet can be sent anywhere on earth without asking permission from a bank, corporation, or government. Launched in early 2009, it solves the long‑standing “double‑spend” problem of digital cash by replacing a central ledger with an open, cryptographically secured database maintained by tens of thousands of independent computers. Every coin is simply an entry on this public ledger, but that ledger has never been hacked or reversed; transactions settle in minutes and cannot be canceled, censored, or inflated at will. Because new bitcoins are issued on a fixed schedule that ends at 21 million coins, many people treat it as “digital gold”—a scarce, portable, verifiable store of value native to the internet.

Genesis: From White‑Paper Idea to Worldwide Network

On 31 October 2008 an anonymous figure calling themself Satoshi Nakamoto e‑mailed a nine‑page PDF titled “Bitcoin: A Peer‑to‑Peer Electronic Cash System.” The paper showed how public‑key signatures, peer‑to‑peer networking, and proof‑of‑work could create digital cash that moved without banks. Two months later, on 3 January 2009, Nakamoto mined the genesis block, embedding The Times headline, “Chancellor on brink of second bailout for banks,” inside its coin‑base field—an understated protest against rampant bail‑outs. Nine days later, cryptographer Hal Finney received ten bitcoins in the first person‑to‑person transfer, proving pure math could carry real value across the internet.

Understanding Bitcoin’s Core Technology

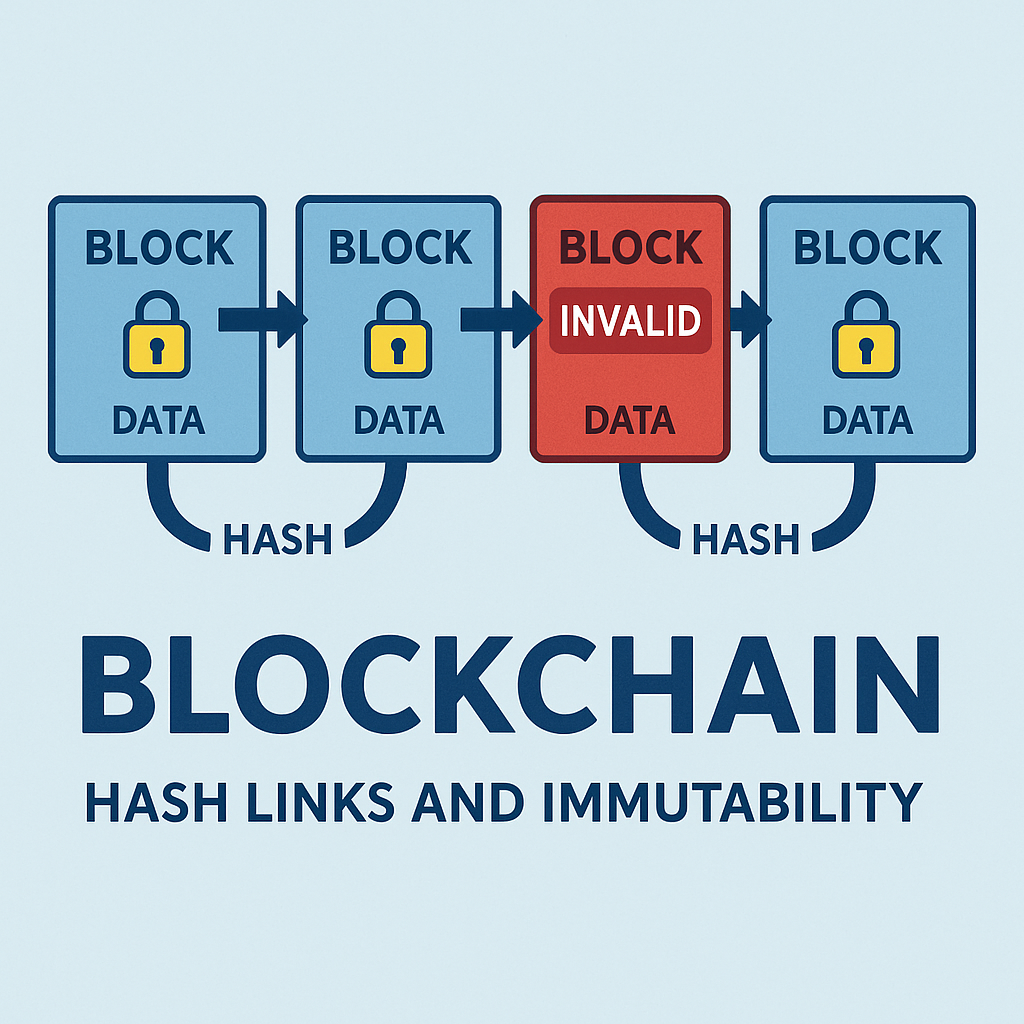

Blockchain Ledger

Picture a ledger that everyone can read but no one can secretly rewrite. Bitcoin’s blockchain is just that: every ten minutes a fresh “page,” or block, is packed with transactions and cryptographically linked to the previous page. Any attempt to modify an old record would require recomputing every subsequent hash faster than the honest network can add new ones—an economic impossibility for anything less than a global super‑majority of computing power.

Proof‑of‑Work Consensus

Rather than tallying human votes, Bitcoin tallies energy. Miners collect pending payments, assemble a block, and race to find a nonce that makes the block’s double‑SHA‑256 digest fall below a difficulty target. The first valid solution propagates across the network; other nodes verify the math and extend the chain. Difficulty auto‑adjusts every 2 016 blocks so discovery time stays near ten minutes no matter how much computing power joins or leaves.

Cryptographic Foundations

Three battle‑tested primitives form Bitcoin’s security tripod:

• ECDSA/Schnorr signatures prove coin ownership.

• SHA‑256 links blocks and builds the Merkle tree summarising each block’s transactions.

• RIPEMD‑160 compresses public keys into human‑shareable addresses.

All remain unbroken after years of academic and hacker scrutiny, giving Bitcoin one of the most robust security stacks online.

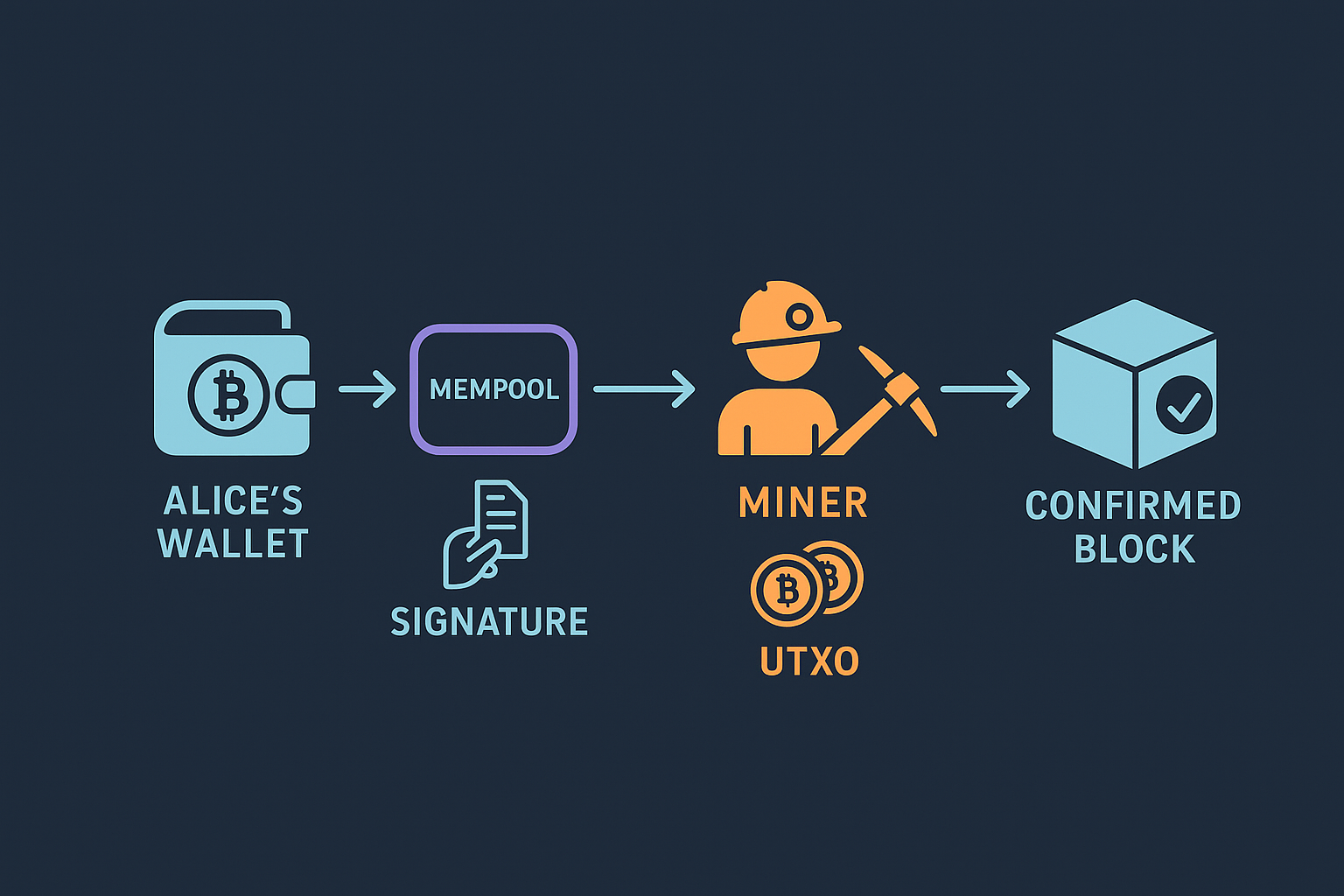

How Bitcoin Transactions Work

When Alice sends bitcoin to Bob, her wallet selects unspent outputs (UTXOs) that cover the amount, signs the new transaction with her private key, and broadcasts it. The transaction enters every node’s mempool until a miner includes it in a block. One confirmation signals network acceptance; six confirmations (≈ sixty minutes) make the payment final for large transfers.

A minimalist scripting language allows advanced spending conditions—multisignature vaults, time‑locked contracts, and the hashed time‑locked contracts that power the Lightning Network—without inflating the attack surface.

Bitcoin’s Economic Model

Programmed Scarcity

Only 21 million bitcoins can ever exist. Roughly every four years (210 000 blocks) the block subsidy halves, dropping from 50 BTC in 2009 to 3.125 BTC after the 2024 halving. This disinflationary curve mimics the gold‑mining schedule and makes long‑term supply predictable, a stark contrast to central‑bank currencies that can be expanded at will.

Miner Incentives

Miners earn (a) the subsidy and (b) transaction fees. As halvings shrink subsidies, fees gradually shoulder more of the security budget, ensuring miners stay aligned with network health in a post‑subsidy era (after ~2140).

Volatility and Price Discovery

With supply fixed and demand free to fluctuate, price is a barometer of sentiment, policy changes, ETF launches, and macro shocks. Boom–bust cycles often see 70 percent draw‑downs, yet each halving era has so far culminated in new all‑time highs as adoption broadens.

Legal Status and Regulation

United States & Europe

The CFTC classifies Bitcoin as a commodity, the IRS taxes it like property, and SEC‑approved spot ETFs (2024) give pensions and mutual funds compliant exposure. Europe’s MiCA framework (effective 2025) standardises licensing and reserve audits, providing regulatory clarity across the bloc.

Supportive Jurisdictions

El Salvador designated Bitcoin legal tender in 2021, Switzerland’s Zug canton lets firms settle some taxes in BTC, Singapore grants payment‑service licences to compliant exchanges, and the UAE’s ADGM drafts crypto‑first statutes to woo global desks.

Restrictive Environments

China banned domestic trading and mining in 2021, yet hash‑rate resurfaced in Kazakhstan, Texas, and Norway within months. Nigeria briefly blocked bank transfers to exchanges before pivoting to licensing; India taxes gains at 30 percent plus 1 percent TDS, discouraging day‑trading but stopping short of a ban.

Bitcoin’s Technical Infrastructure

Full Nodes

Running Bitcoin Core on a Raspberry Pi 5 with a 1 TB SSD (≈ €200) lets anyone verify every rule themselves. Full nodes reject invalid blocks, route valid transactions, and underpin decentralisation.

Mining Hardware

Industrial farms deploy air‑ and immersion‑cooled ASICs topping 200 TH/s apiece, usually co located with stranded hydro dams, geothermal plants, or flare‑gas fields. Home miners still join via pools but rarely beat residential power rates.

Layer 2 Scaling

The Lightning Network holds more than 10 000 BTC in public channels and facilitates instant, sub‑cent payments by batching many off‑chain updates into occasional on‑chain settlements.

Side‑chains & Assets

Liquid offers one‑minute block times for traders; Rootstock adds EVM‑compatible smart contracts; emerging drive chains could let any side‑chain borrow Bitcoin hash‑rate via blind‑merged mining. Taproot Assets and RGB use client‑side validation to issue stable coins or NFTs without bloating the base layer.

The Future of Bitcoin Technology

Privacy Enhancements

Taproot already hides multi sig complexity; MuSig2 will aggregate multiple signers into one signature, cutting fees and masking participant count. Silent Payments research could let wallets generate invisible receive addresses, boosting default privacy without sacrificing auditability.

Covenants & Vaults

Proposals like OP_CHECKTEMPLATEVERIFY and ANYPREVOUT would enable vaults that impose a delay or second key for spending—on‑chain insurance against seed compromise.

Energy Evolution

ASIC efficiency doubles roughly every two years while miners migrate to ultra‑cheap renewables or act as controllable loads. Methane‑capture rigs turn flare gas into hash‑rate, cutting net CO₂ versus venting. Grid operators increasingly view miners as buyers of last resort that stabilise demand.

Institutional & Nation‑State Integration

US, UK, and Japanese spot ETFs already custody over 800 000 BTC. Lightning invoices now plug into ERP suites for real‑time cross‑border settlements. Resource‑rich nations lacking correspondent‑bank access contemplate Bitcoin rails for exports, reducing reliance on dollar clearing.

Bitcoin consumes ~170 TWh yr (≈ 0.3 % of global electricity). Critics liken this to the footprint of a medium‑size country; supporters cite a > 40 % renewable share and argue PoW monetises wasted energy that previously had no buyer. Reality sits between: Bitcoin’s carbon intensity depends on location and improves as miners chase stranded or overbuilt renewables.

Privacy is pseudonymous, not anonymous—chain‑analysis firms can cluster addresses. Using Tor, CoinJoin, PayJoin, and non‑custodial Lightning raises the privacy bar, but perfect secrecy demands continual vigilance.

Governments cannot “switch off” Bitcoin without unprecedented global coordination. China’s sweeping bans merely displaced miners; the network’s hash‑rate set fresh highs six months later, underscoring geographic resilience.

• Acquire prudently – fund regulated exchanges via bank transfer, not high‑fee cards.

• Self‑custody early – withdraw to a hardware wallet; engrave your seed on stainless steel and store copies in separate places.

• Run a node – verifying your own transactions removes middlemen and strengthens the network.

• Think in sats – 1 BTC equals 100 000 000 satoshis; pricing coffee at 9 200 sats feels intuitive.

• Stay tax‑compliant – track cost basis, export CSVs; penalties sting more than bear markets.

Bitcoin began as a niche cypher punk project and now anchors a borderless settlement system used by individuals, companies, and—slowly—nation states. By replacing trust with open‑source code plus economic incentives, it proves that scarcity and property rights can be enforced by math, not decree. Each new block, every ten minutes, is a timestamp on human ingenuity. As hash‑rate climbs, institutional rails expand, and Lightning brings instant micropayments to phones worldwide, the 21‑million‑coin revolution continues to redefine value, ownership, and economic sovereignty in the digital age.